New normal in payments and win-win strategy for everyone

A global digital transformation in the financial market is underway. Changes are not limited to a specific market niche, technology, product or process. Digital disruptors are forcing financial services companies to accelerate digital transformation, and those unable to adapt may continue to exist formally but without the ability to compete in the market effectively. Regulations such as the Second Payment Services Directive (PSD2) are putting the European region in leading positions of payment transformations.

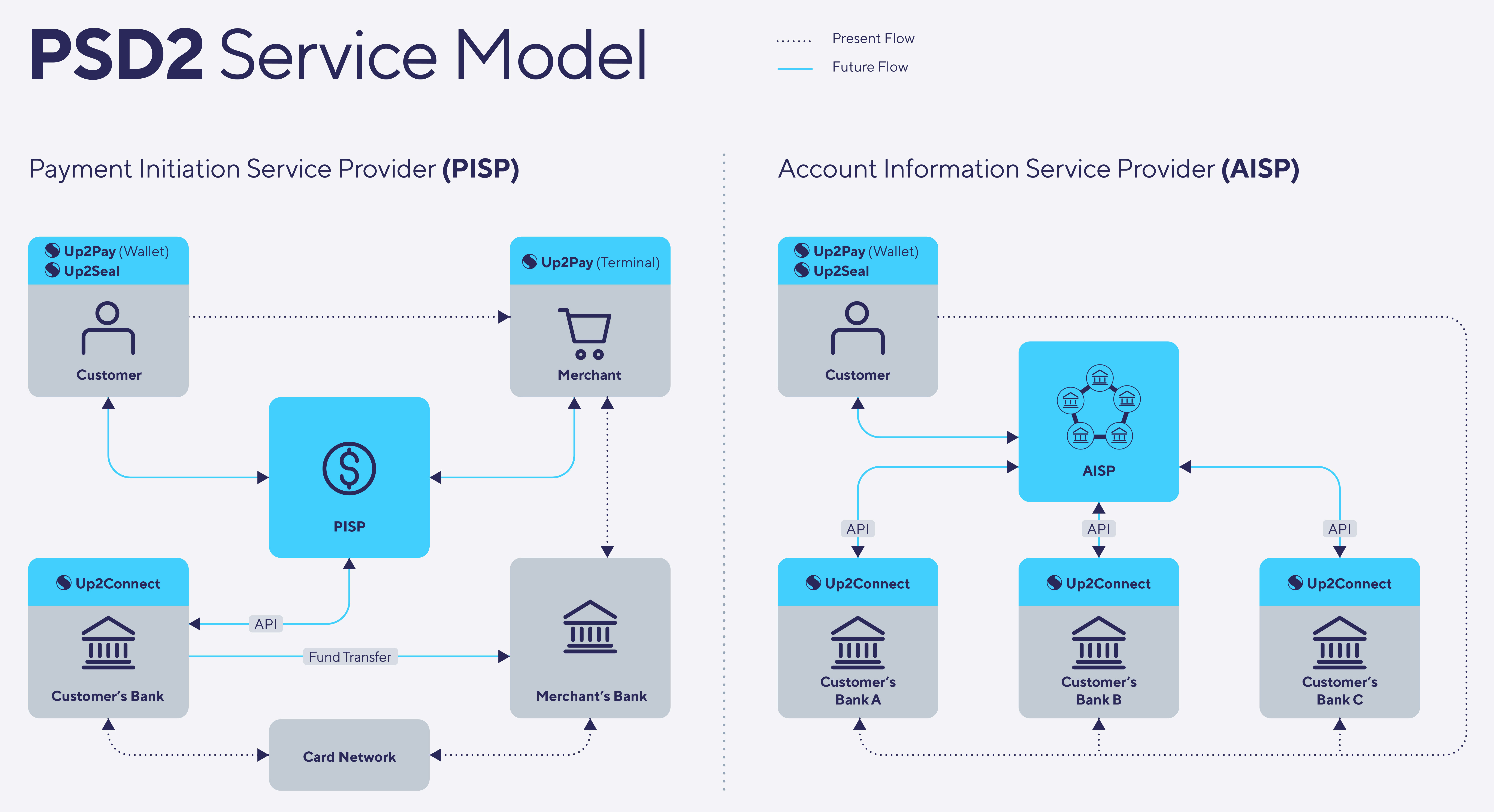

Open banking and instant payments are one of the significant factors for the future system change – retail payments are switching from card-based transactions to account-account ones. In response to this rapidly changing environment, Sirma has developed a complete software solution that all parties involved in the payments ecosystem can benefit.

Sirma provisions the right technology and ready-to-use fintech products, which the open banking strategy requires

Sirma’s new flagship product - Open Banking Suite, is a modular solution providing all the necessary PSD2-compliant services and products for the financial sector. Open Banking Suite is among the best solutions for financial institutions or third parties that see PSD2 as an opportunity to create additional revenue streams. The modular architecture of the product allows both integration as a package or the use of each module, that reflects the individual business needs of the financial organization.

All in one - interface, security and payments. Use as a package or only the module you need

Complete solution for the financial sector that ensures a frictionless PSD2 journey. Open Banking Suite is the best choice for financial institutions or TPPs, which see PSD2 as an opportunity for generating additional revenue streams.

Open Banking Suite is a end-to-end solution that includes three separate modules - Up2Connect, Up2Seal, and Up2Pay. The modules could be used individually or as a package, depending on the specific needs of the organization:

Up2Connect is the module that provides a set of APIs, ensuring full compliance with open banking. Up2Seal provides enhanced security for customer authentication by safeguarding secure payment approval based on the 2FA or MFA methodology.

While the first two modules are solutions for the back-end and security of financial institutions or fintech providers, the third module is a solution for all participants in the value chain - banks, merchants and end users.

Up2Pay is Sirma’s top-notch solution for open banking payments. It helps users to register their accounts from different banks in one digital wallet and to make digital payments with a software POS terminal.

UP2Pay is our game changing open banking payment solution

Here is the list of benefits that all participants in the value chain obtain with Up2Pay:

- A digital wallet app combining information for all bank accounts and payment instrument

- Account to Account payment initiation and approval

- Physical face-to-face, online e-commerce, and offline payments supported

- Account Information service available - customers can check available balance and transaction history

- Merchant 3D digital payment identity – a QR code with the whole payment data needed for on¬line payment initiation

- Offline payments through QR code support

- P2P payments

- Biometric authentication

- Enhanced PSD2 payment processing

Benefits for Banks

- Increase in the electronic payments – a new channel for payment initiation

- Significant clearing and settlement cost reduction compared to card-based transactions

- Easily organizing a closed-loop network with your merchants and customers so all revenue streams are kept in the bank

- Powering marketplaces, platforms, and almost everything that’s sold online.

- Account information aggregation can provide additional information for customers which can be used in the loan approval and direct marketing activities

- New revenue stream - transaction fees paid by the customer and merchant fees

- Ensure increased security – SCA based transactions without sharing any critical customer data

- Provide fully digital customer experience – mobile application and frictionless one-click checkout and SCA PSU experience

- Enhanced customer loyalty – the churn rate with digital customers is quite lower

- Customers connect securely to their internet or mobile banking to make a payment

- Reward schemes for profitable and efficient customer portfolio

- Additional transactional data for corporate clients and it their customers, which can be used for deep behavioral analysis

- Account aggregation if registered as PSD2 TPP

Benefits for Merchants

- Reduced costs for payment acceptance

- Real-time payments – combined with instant payments, the merchant will receive funds faster than card payments

- Fully digital experience and enhanced reporting

- Smooth and seamless integration - pre-approved API widgets for online stores

- Lower levels of Fraud and Chargebacks due to Strong Customer Authentication

- Straightforward checkout process and lower cart abandonment rate

- No credentials or account details disclosed to merchant, and no PCI DSS requirements

- No charges on failed or declined transactions

Benefits for Customers

- Anti-pandemic cashless digital payment tool

- All-in-one solution for account information, payment initiation and rewards

- Enhanced digital & mobile customer experience

- Single tech solution for a loyalty program from different service providers

- No new accounts needed, use all current available ones with all EU payment institutions

- Manage personal finance with payment planning, balance updates and reporting at fingertips.

- Enhanced transaction security with Strong Customer Authentication

- P2P payments between wallet users

It’s never been easier to unleash your potential for innovation with Sirma’s Open Banking Suite. It guarantees easy, convenient and secure customer access to your banking products. The biggest advantages as modularity, independence from basic banking software and security of digital payments make it most wanted ready to use innovative product for your organization.

For better customer experience and meaningful relationships we suggest you to combine OBS with our Customer Intelligence Suite and to organize loyalty programs and campaigns, loyalty cards and mobile loyalty app and automated proactive interaction with your customers through virtual assistant chat-bot.

Why Sirma?

Sirma’s team has unique knowledge and experience in providing banking solutions based on API integration, implementation of open banking solutions and large scale projects for numerous Bulgarian and international banks.

We help our clients undertake overall digital transformation by providing IT and business consulting, advising them for the best choice of technical architectures based on microservices and many more. Our clients are able to implement single or set of technologies that support their digital strategies. Our unique experience in the integration of core banking software within various IT infrastructures has been gained for over 15 years.

Up2Pay - Grow your payments market with direct access to the bank accounts

Let’s talk about your winning open banking strategy! We can help you implement new profitable business models.