Did you know that more than a quarter of bank customers in Europe (26%) have already switched banks due to dissatisfaction with digital services, and many would do so again? At the same time, nearly half of customers (47%) say that better digital services would significantly improve their overall fulfilment. This makes digital channels a clear pain point, one that deserves special attention.

However, digital channels are no longer a true differentiator for banks. With the average customer interacting with their bank every three days (across a mix of digital, phone, and in-branch channels), they have become a basic expectation rather than a competitive advantage.

In this article, we will discuss how technology can contribute to banks’ customer retention and will present some proven strategies for enhancing it. We will also outline the AI’s potential in the area.

Why is It Essential to Keep Customers Engaged?

Consider this: acquiring a new customer costs five to seven times more than retaining an existing one, and the likelihood of selling to an existing customer is 60–70%, compared to just 5–20% for a new prospect. It is obvious: customer retention is a top priority. However, the share of customers who consider switching banks remains a persistent concern – 23% of people worldwide say they plan to do so in the next year.

According to the same research, the top four reasons for customer churn in banking are:

- Poor digital experience – an underperforming mobile app is a key reason for daily frustration;

- Impersonal service – when customers lack personalized care, their loyalty diminishes;

- High or hidden fees – for contemporary customers, transparency in pricing is non-negotiable;

- Lack of proactive support – it happens when banks are absent during a significant life event.

Although high costs have traditionally been the primary reason why customers seek alternatives, the last year saw significant progress in reducing them. However, we can safely presume that the other bottlenecks persist. The good news is that technology, through its ability to leverage customer data and apply it proactively, can be a powerful ally in overcoming them.

Key Strategies for Driving Retention

A popular white paper on customer retention in banking identifies five key customer retention strategies, observed across both large and small banks, as well as digital-only banks. These include:

- User experience – involves ensuring a seamless and intuitive user experience across omnichannel offerings. Here, introducing user-friendly interfaces (apps, websites, and branches), as well as integration with third-party platforms, form a major approach for attaining it.

- Customer segmentation – includes achieving a 360-degree view of the customer to better understand their needs. Tools for achieving it include customer data analysis and predictive modelling, among others.

- Rewards/ loyalty programs – are expressed in providing customers with monetary and non-monetary awards as loyalty acknowledgement. They may cover cashbacks, third-party offers, loyalty cards, and more.

- Customer engagement – consists of regularly engaging customers through innovative approaches, such as gamification, educational and lifestyle activities, etc.

- Feedback and measurement – are demonstrated in regularly measuring ROI from customer interactions through various indicators.

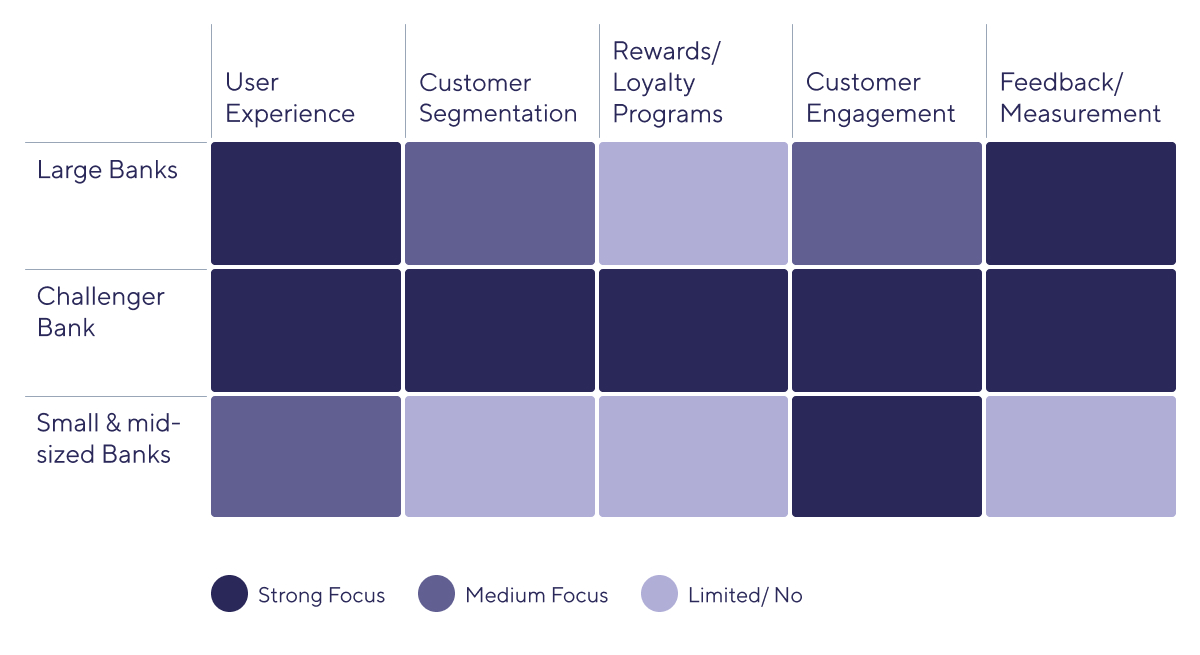

Although similar, the priorities of these approaches are applied differently by the various banks. The following summary table illustrates the distinctions.

Source: Temenos and IBS Intelligence, In the World of Digital Banking, Customer Retention is Key

It’s clear that digital disruptors – namely, challenger banks – are proactively leveraging all five customer retention strategies. Large banks will need to strengthen their loyalty programs, while small and mid-sized banks must improve their customer segmentation, loyalty initiatives, and feedback measurement. Across the board, user experience is given the highest priority of all five strategies.

The Role of AI Technology for Customer Retention

Technology plays a central role in ensuring customer retention in banks by making banking faster, more personalized, and more trustworthy. Yet, the advancement of AI brings even further options, significantly improving customer experience, operations, and fraud prevention, and freeing time for employees to focus on strategic tasks such as relationship-building.

Here is how AI can be streamlined to assess and improve your customer journey:

- Optimization of the user experience (e.g., deposit applications or onboarding experience) – you could analyze your deposit application process and identify bottlenecks that lead to application abandonment. For example, you could introduce enhanced digital account opening with mobile-friendly features and pre-filled forms for returning customers.

- Deepening of the customer relationship through personalized communication – via appropriate solutions, you could regularly update customers on their financial status or notify them of relevant products.

- Ensuring a seamless omnichannel experience – although still only 65% of banks provide mobile experience, its usage is consistently on the rise. Still, you should build consistent customer experience across all touchpoints.

- Using hyper-personalization to enhance offers – using data to analyze individual behavior will enable you to create and promote personalized product offers, which can help you improve retention.

- Creating a loyalty program – leveraging customer data to offer incentives for high-value customers can strengthen loyalty and “increase the appeal of banking” with your institution.

- Improving efficiency and productivity – you can apply AI to streamline operational processes, especially those related to maintaining account-holder relationships. You can achieve this by turning data into action, identifying opportunities for workflow automation, enhancing fraud detection and automating compliance management, to name a few.

- Enhancing security – AI’s potential to flag fraud in real-time will significantly increase the reliability of banking for your customers.

Technology has shifted banking from a place customers visit to a service that lives in their pocket. By delivering seamless access, personalized experiences, robust security, and innovative features, it strengthens trust and deepens engagement. When customers feel their bank understands them, protects them, and makes their financial life easier, they have little reason to look elsewhere – making AI technology one of the most powerful drivers of retention in modern banking.

Final Thoughts

Retaining customers is a top priority for banks, which pursue various strategies to achieve it. Although different banks employ customer retention strategies in various ways, technology plays a crucial role in their implementation. AI elevates contemporary banking to data-driven partnership, helping industry to offer hyper-personalized services and significantly improve customer experiences. Blending convenience, personalization, and innovation makes customers less likely to leave. If you’re interested in enhancing your customer retention strategy via the latest technologies, please don’t hesitate to contact our financial services team.