Our Chief Commercial Officer - Momchill Zarev shares his current experience with AI-based solutions, which are in high demand in the banking industry. Momchill Zarev has led Commercial Operations in Sirma Solutions JSC since 2020.

We can realize the scale of digital transformations in the banking industry for the last two decades by a quick flashback. In the beginning, bank customers’ behavior and interaction with organizations were mainly in-person, with physical visits to a bank office, live communication, and paper documents exchange. Later, were launched essential Internet banking services, but their adoption was relatively slow, despite the convenience they provided. Not long after, were introduced mobile banking and various related services. They made the boost needed to speed up the industry. As a result, we have witnessed a surge in online banking, digital payments, loan applications, etc.

The proliferation of digital services naturally led to the demand for next-generation software solutions, which complement existing ones or are brand new for the institution. To name a few - intelligent virtual assistants (chatbots) which are a new communication and sales channel, digital wallets and video banking which are becoming a vital part of retail and corporate banking.

Are the banks open to integrating AI-based solutions to improve their workflows and employee performance?

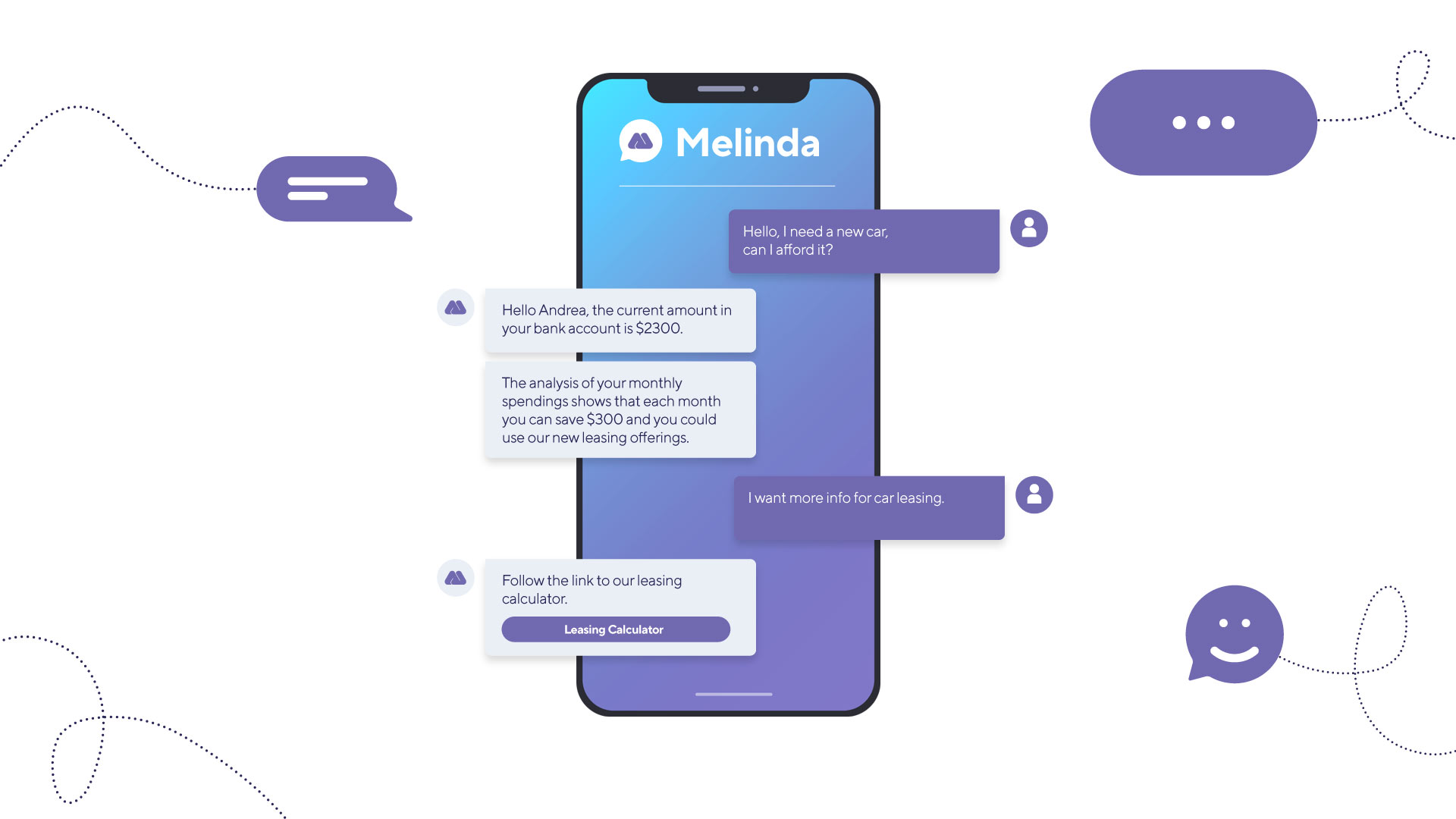

Technological solutions, like chatbots, are designed to facilitate call center employees’ work and fill the gap not covered by the Internet and mobile banking, particularly in offering personalized products and services to each customer. These solutions provide customers with an environment to ask questions about products and services, send inquire about the offer they are interested in, regardless of lack of financial knowledge about them. For example, a client starts a chat with the query, “I need a new car, what does it take to get funding”?

The virtual assistant can provide complete information about the available credit options without using keywords such as “credit”, “leasing”, etc. This type of communication is possible due to the intensive development of artificial intelligence algorithms, machine learning, natural language processing (NLP) technologies, enabling the computer to analyze and understand what the person is asking, rather than using specific terms. These technologies make it possible to understand natural language questions and, accordingly, the consumer’s natural response, which banking consultants previously have carried out.

AI is one of the areas where Sirma is a leading company – with almost 30 years of technological expertise and know-how. Our chatbot platform Melinda enables banks and financial institutions to create the best solutions empowered by AI. The chatbot has Speech-to-text and text-to-speech functionality; it can mimic natural conversation on intelligent voice devices.

What is the main competitive advantage of Melinda?

Melinda is an intelligent bot of a new generation, it changes the communication flow with customers. When interacting with Melinda, there is no need to use specific terms in the queries. With AI’s help, the bot understands the intentions, and the conversation is closer to natural speech. This is an untapped opportunity to offer more banking services and go beyond the hitherto imposed role for chatbots, namely to help customers if they use only specific keywords and predefined issues. The new generation of bots is becoming a channel for active sales, lead generation and communication. Through integrations with existing systems, it is possible to provide services available on the Internet and mobile banking, such as personalized data for account balances and analyzes, account movements, loan liabilities, etc. Also, Melinda can perform active operations as initialization of transactions, applying for loans, opening accounts, etc.

”Melinda creates a personalized and proactive customer experience in the context of natural conversation.”

We also have another AI-based solution, which carries out Big Data analysis. The technology helps banks to generate analytical reports, gain insights and create recommendations for the clients. Using Melinda and Big Data’s combination enables banks better to understand their customers, individual needs, and preferences. The knowledge that banks extract from data silos helps them know better customers’ needs and improve the quality of products and services offering.

360 view, why it is so important?

Customer profiling and banks’ ability to obtain a 360 view enable them to create a personalized offering based on customer personal track record, product life cycle, and customer life stages. This functionality is still scarce in the banking sector in Bulgaria. For example, an individual needs a consumer loan or wants to buy one on leasing. Then comes the mortgage loan; over the years, customers consider investment products, private pension insurance, life insurance, change of home.

It is not rare for the customer to be also a business user in the same bank, and then there are other possibilities - company lending, investment loans, etc. So, financial advisors can expand their proposals in many directions. The 360 view helps the employees obtain information about customers spending, their aggregated funds, even more, to get predictive models regarding the future consumption of products and services. Financial institutions already store these data, but they exist in different silos, and artificial intelligence technologies allow us to link them and obtain comprehensive information about the customer.

Can we use AI technologies to prevent market manipulations and frauds?

The application of AI in banks and investment companies opens an opportunity to identify suspicious trading activities, analyze and search for specific models in the actions performed by a trader or other market participants. As the sector is highly regulated, such as models, behaviors, and objects are well defined. The suspicious commercial activities are called “warnings”, which are alerts for possible market abuse.

Risk and compliance officers review alerts and, based on actual transactions enriched with additional contextual information (news, emails, voice communications, market data, historical trading activities performed by the trader), determine whether alerts need further investigation.

Last but not least, the possibilities for detecting illegal actions and fraud, so-called fraud detection, and risk scoring, are performed through technologies based on machine learning and AI. They allow identification of legitimate yet dubious in nature and logic, financial transactions, which facilitate banks in their countermeasures and prevent money laundering.