Notifications

A comprehensive communication-management system that automates customer notifications for financial institutions. It standardizes, customizes, schedules, and executes notifications regarding transactions, accounts, cards, credits, and reports.

The software distributes timely and accurate information to bank clients via traditional paper notifications, SMS, e-mail, and all popular chat platforms. This multi-channel communication system is flexible and adaptable to cater to different clients’ varying needs and preferences. The service enables financial institutions to provide the information their clients need in the format they prefer.

SCARDS

SCARDS is a web-based application designed to automate all payment and card management back-office processes within financial institutions. This solution enables the full automation of service processes in the Payment & Card Center, which increases transaction speed, reduces operational risk, and enhances customer experience. By providing overall management of the card lifecycle, SCARDS offers a range of advantages to both financial institutions and clients.

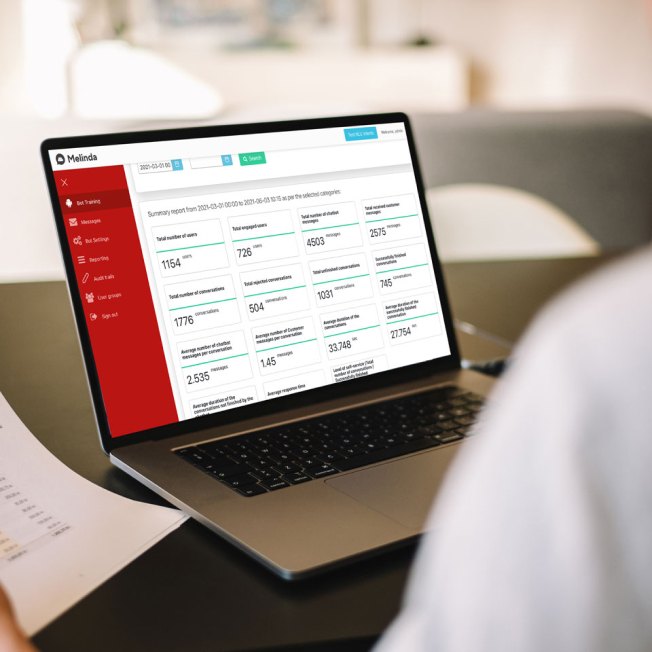

DIBA

An end-to-end IT solution helping banks utilize business-critical electronic channels. DIBA gives access to a flexible self-service portal providing users with online onboarding and management of personal finance, accounts, transactions, utility bill payments, and timely notifications, reports, and statistics.

The end-user interacts via the web, apps and virtual bot assistants. The solution is suitable for banks, payment and e-money institutions, account information service providers (AISP), payment initiation service providers (PISP), credit brokers and fintech companies.

The system can provide API banking and smooth integration of other financial services related to Cards, open banking, Insurance, Pension assurance, and Private banking products.

Payment Portal

Payment Portal is a secure, reliable, and versatile payment processing system for financial institutions. It ensures compliance with international banking regulations and standards and supports a wide range of payment systems, including SWIFT, SEPA, TARGET2, and PSD2. With Payment Portal, you can exchange information securely, process payments quickly, manage liquidity in real-time, and enjoy dependable performance. It suits banks, payment and e-money institutions, third-party providers, and more.

Automation triggered by events

Automation triggered by events  Templates

Templates  Multi-channel delivery

Multi-channel delivery  Scheduling

Scheduling  Web interface

Web interface  Real-time manager

Real-time manager  Notifications

Notifications  Card products

Card products  Fee management

Fee management  Risk mitigation

Risk mitigation  Fraud prevention

Fraud prevention  Compliance

Compliance  Bonus schemes

Bonus schemes  Customer care

Customer care  Secure and reliable environment

Secure and reliable environment  Integrated electronic services

Integrated electronic services  Cross-functionality

Cross-functionality  Convenient user interface

Convenient user interface  Automation of the payment process

Automation of the payment process  Robust user and transaction security

Robust user and transaction security  UX/UI for Superior user experience

UX/UI for Superior user experience  Connectivity with multiple payment systems

Connectivity with multiple payment systems  System flexibility

System flexibility