The customer experience has been a focal topic in recent years, especially when it comes to digital finance. The Covid-19 pandemic has forced both bank customers and financial institutions to become more open to innovations in using financial services. Historically, banks were among the first adopters of digital services and specifically in customer service processes. A large part of the operations was digitalized – for instance, payments - cards, internet and mobile banking, etc. One of the most popular and promising digital services is the digital wallet due to the opportunities it provides for payment from various devices - smart watches, bracelets, phones and more. The biggest mobile phone manufacturers offer their solution - Apple Pay, Google Pay, Samsung Pay, Huawei Pay, etc.

As a primary provider of payment services and instruments, banks have begun to realize their severe delay in developing their own digital wallets. Those who created such a product in the last year have launched digital wallets based on cards. However, the latter does not offer richer functionalities than those provided by Apple, Google, Samsung and other BigTechs.

What should be the critical differentiator that can distinguish the new digital wallet and give the banks a crucial advantage?

Open banking and the PSD2 make developing and implementing innovative digital wallets fast and efficiently; however, this option is not considered an urgent task by banks. Most of them did an excellent job in regulatory compliance but still do not explore the full innovation potential offered by the PSD2. The design of digital wallets based on account-to-account payments is one of the opportunities that revised regulation offers. It can help banks increase the volume of payments executed through direct access to accounts, no matter which bank they are.

Sirma has developed its digital wallet for banks, called Up2Pay, which uses the available Open banking processes to carry out payment transactions initiated by a merchant and authorized by the PSU /Payment Service User/. The digital wallet performs account-based transactions, enables easy and quick payments between accounts, and lower transaction costs, which puts the digital experience at the centre of financial service. The digital wallet can be used together with the existing mobile payment systems, allowing customers to pay for their smartphones. It also provides instant payments and the opportunity to organize pan-European payments without the need for additional operators.

Up2Pay targets В2В clients - banks, insurance companies, leasing companies, wealth managers. We offer it as a white-label (WL) solution with a secure and robust technology behind it. Banks will get a branded solution with a distinctive yet simple UI/UX, handy usage, and catchy features. The main advantages to opting for WL are the fast deployment, which frees up banks to invest in software development from-scratch and minimizes the support cost.

Outside financial institutions, there are a large number of chain retailers and online retailers, which would have a potential interest in adopting such a solution. The digital wallet would significantly reduce transaction fees and commissions and add merchants’ option to receive instant payments. There is a requirement for non-financial organizations they must register as a payment institution (PSP). These merchants may not wish to engage with licensing and process payments by themselves. Instead, they can work with a TPP already available on the market. For Bulgaria, Sirma partners with the first PSD2 licensed institution IRIS Solutions.

All accounts in one wallet

Up2Pay is a digital wallet that brings benefits not only to businesses but also to bank customers. They can store the information about all their bank accounts in one place and at the same time make payment transactions, choosing the account they want (regardless of which bank it is in). The transactions are based on the current account, which determines easy and fast payments. The digital wallet can be used with existing mobile payment systems, allowing customers to pay for their smartphones.

Your digital wallet brings numerous benefits to all value chain players - banks, merchants and end-users. To name a few - significant clearing and cost reduction compared to card-based transactions. The wallet enables the creation of a closed-loop network with merchants and customers. Also, it opens a new payment channel - increases volumes in the electronic payments for payment initiation. One of the essential advantages of the digital wallet is the real-time payment, which, combined with instant payment, carries out funds faster than the payments made with a card - less than 30 min. Last but not least, the transactions are secure without sharing any critical customer data.

Payment institutions can build a thriving business using the following functionalities of the digital wallet:

- Account to Account payment initiation and approval

- Instant payments between wallets

- Account Information – check available balance, transaction history and reports

- Management of physical and virtual card operations

- Bill payments

- In-store payments using NFC or QR code scanning

- Biometric authentication

- Omni-channel payments - physical face-to-face, online and offline payments

- Option for integration with AI-based Chatbot

- Fully digital customer experience - mobile app and frictionless one-click checkout and SCA / PSU experience.

- SCA based transactions - secure, without sharing any critical customer data

- Integration with loyalty and rewards software.

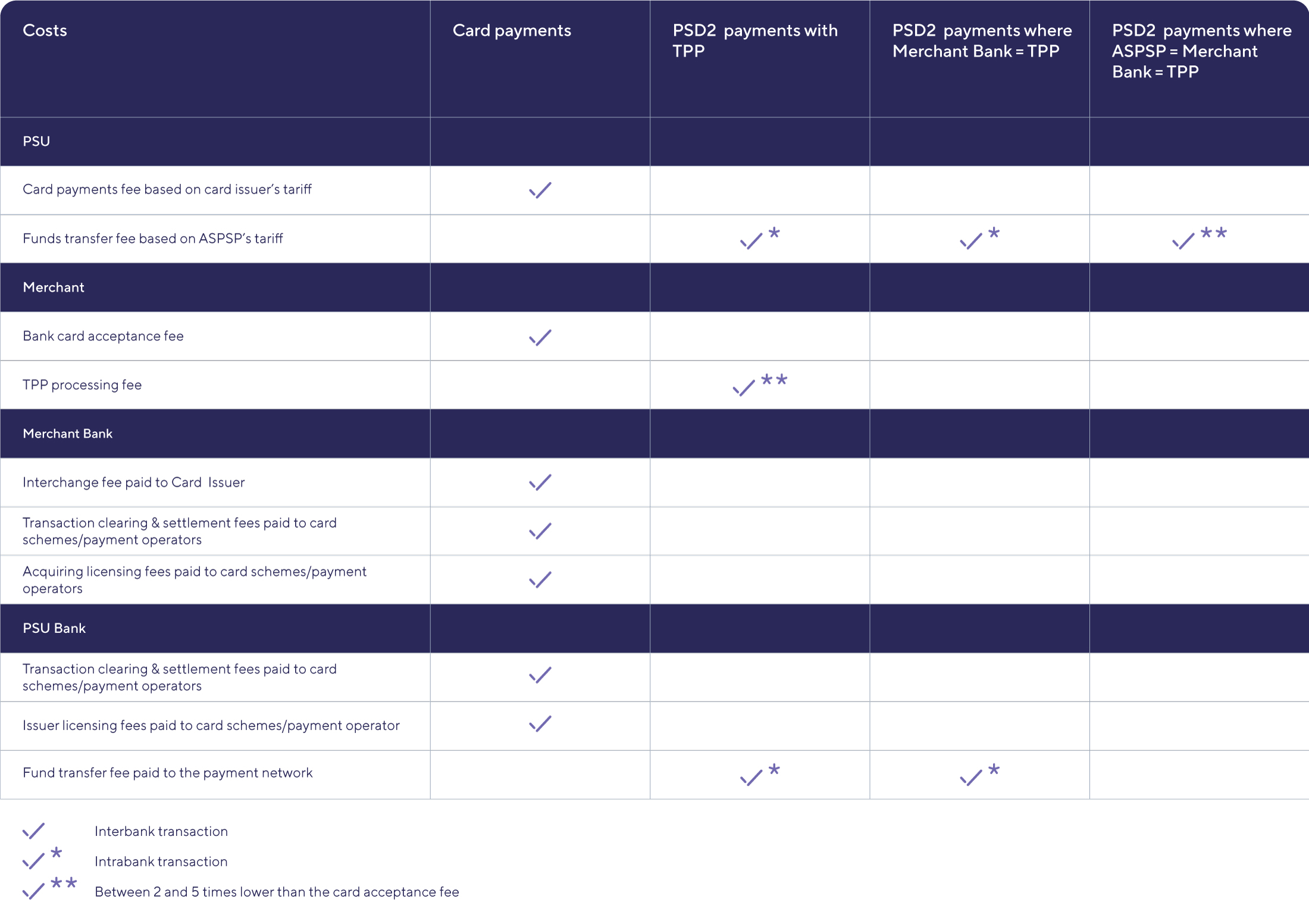

Let’s compare the costs in transactions value - between cards and PSD2 based payments:

Merdihan Ismailov, Financial Institutions and Banking Products Manager of Sirma