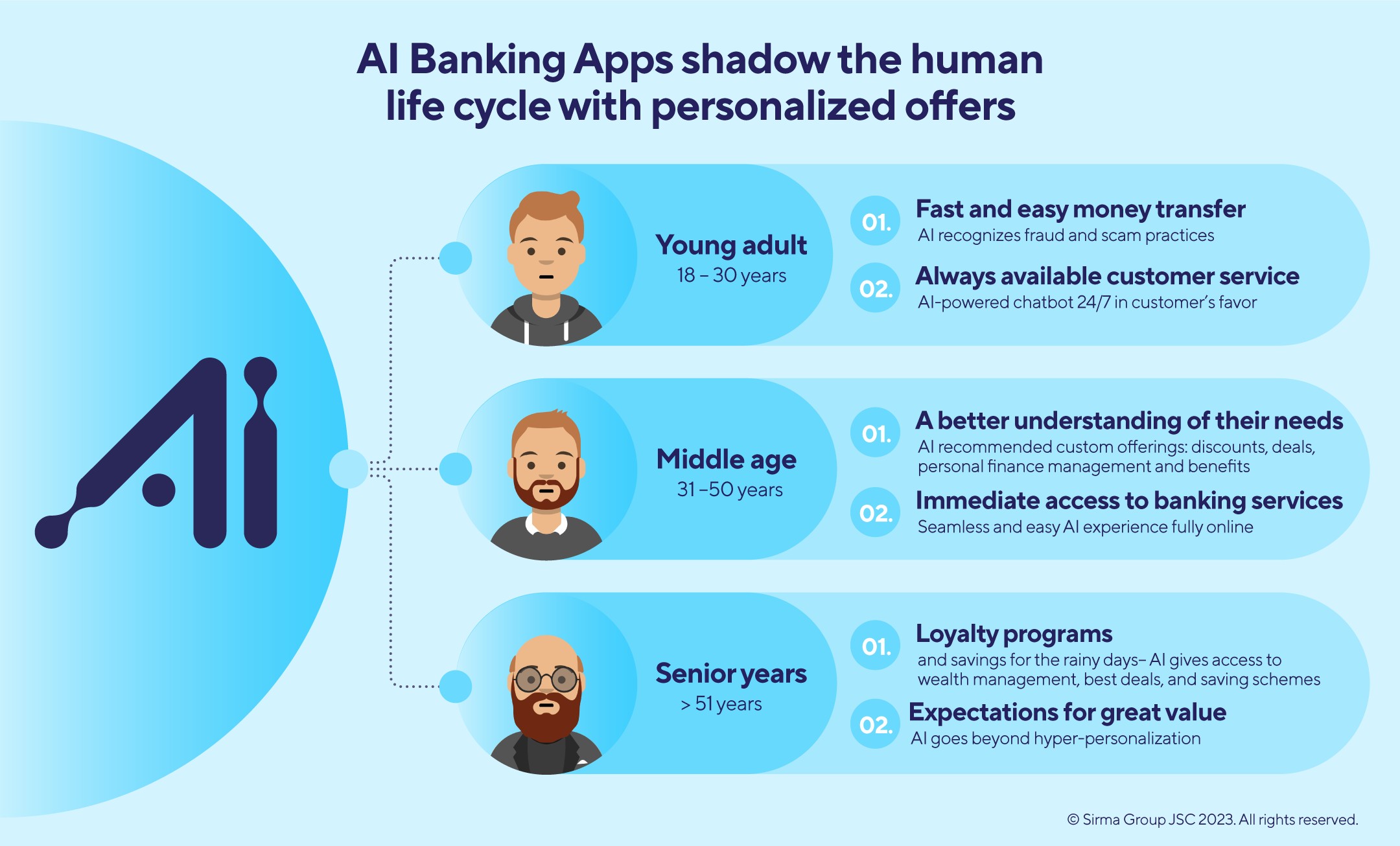

AI-empowered features help banks create personalized offers and address the evolving needs of their customers

Technology has become an essential part of our daily life in today’s fast-paced world. The banking industry is no exception, as banks are now turning to AI (Artificial Intelligence) to enhance the customer experience and improve their services. AI in banking can be used in various forms, such as chatbots, virtual assistants, and predictive analytics. However, one area that has not been explored more in-depth is how AI is implemented in a way that can serve the different stages of the human life cycle.

Navigating the Needs of Young Adults with AI-Powered Banking Services

Yung Adult: 18 – 30 years old

For young adults, the most important aspect of banking services is speed and ease of use. They want to transfer money quickly and easily without having to go through a lot of hassle. AI can play a vital role in this by recognizing fraud and scam practices and alerting the customer to any suspicious activity. Additionally, this age group wants to be able to access customer service at any time, which is where AI-powered chatbots come in. They provide 24/7 assistance and can help with any queries they may have.

Enhancing the Financial Planning Journey of Middle-Aged Customers through AI

Middle Age: 31 – 50 years old

As people enter the middle age phase of life, their needs and what is important to them change dramatically. They become more focused on financial planning and management while simultaneously looking for ways to make the most of their money. AI provides a working solution where it recommends custom offerings such as discounts, deals, and personal finance management tools. Moreover, people in this age group are looking for immediate access to banking services, which is why an easy and seamless AI experience, fully online, is essential for them.

Providing Tailored Solutions for Senior Citizens through AI in Banking Services

Senior Years: 51 and older

As humans get older and wiser in their senior years, their priorities shift towards retirement planning and savings for the rainy days. In this stage of life, loyalty programs and savings schemes become more desirable. AI offers easier access to wealth management, the best financial packages, and saving schemes. Furthermore, senior customers expect great value from their banking services, and AI can go beyond hyper-personalization and offer tailored solutions that align with the customer’s goals and values.

Final Words

AI has the potential to revolutionize the banking industry by providing customized solutions that cater to the needs of customers at different stages of the human life cycle. From recognizing fraud and scam practices for young adults to providing access to wealth management for seniors, AI can enhance the customer experience and improve overall banking services. As the world continues to evolve, the banking industry must adapt and evolve with it, and AI can be a valuable tool in achieving this.

Sirma is one of the companies actively working towards AI implementation in fintech. We use natural language processing (NLP) and machine learning algorithms (ML) to provide personalized solutions that serve the whole range of end customers. Our tech stack is designed to be flexible and scalable, allowing us to adapt easily to the changing needs of the banking industry. With cutting-edge solutions and an expert team, Sirma is well-positioned to help banks navigate the human life cycle and provide personalized solutions to their needs.