Two major technology-related forums were held in Bulgaria during the last week of April. Both events - Technovation and Banking Today, are significant gatherings of leading fintech companies, big names in the IT sector, representatives of the banking and financial world, and regulators in Bulgaria. Sirma, a key player in the IT industry, was represented by its leading financial senior leadership — Tsvetomir Doskov and Alexander Stanev — who contributed to the fruitful discussions as panellists at both events, underscoring the company’s commitment to staying at the forefront of the industry trends and developments.

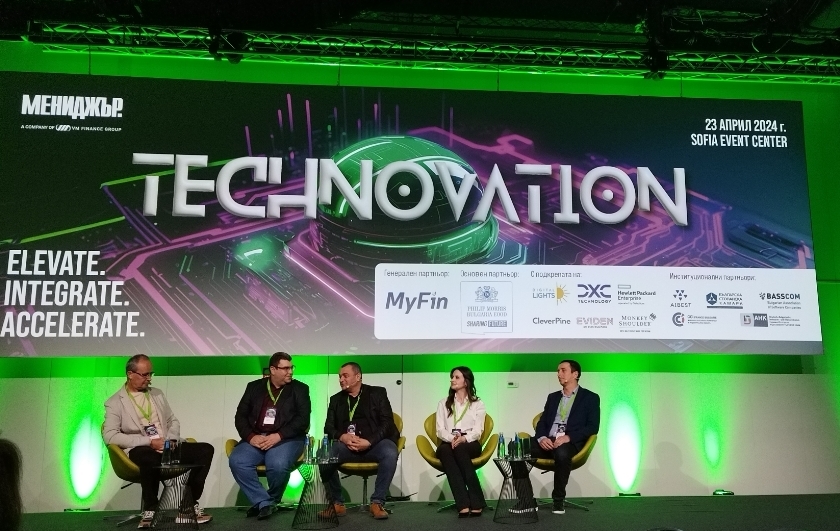

Tsvetomir Doskov, the CEO of Sirma BC and the VP of the financial vertical at Sirma, was a speaker at Technovation - the annual forum organized by the magazine “Manager”. The event took place on April 23 at the Sofia Event Center. The panel titled Fintech: A Cashless Society focused on the latest trends in the use of digital wallets and the shift towards cashless payments among consumers. During the discussion, Mr Doskov shared insights on the most actively implemented applications of AI by banks, such as evolving the wide range of back-office systems, and highlighted what the next generation of technology in the financial sector might bring. He also demonstrated how the large language models would improve digital wallets and other banking products for customers by enhancing interaction and user experience on an entirely new level, such as the next-generation digital wallets, which will embed voice-assisted interaction.

Banking Today, organized by Investor Media Pro, took place on April 25 at the Inter Expo Center in Sofia. It brought together the community of the banking and financial industry, business, consultants, CFO managers of large companies, regulators, and fintech companies to discuss and analyse the trends and future development of the banking, fintech, and insurance sectors in Bulgaria.

Alexander Stanev, Group CTO Finance, represented Sirma at the Panel 3 Business Finance. During the panel, he emphasized the importance of exploring all types of internal data and data entries within the bank’s silos to analyse information in real-time and then create new services and personalized offerings. He also highlighted the value of leveraging LLM to extract relevant and useful information from the overwhelming volumes of regulations and compliance requirements. According to Stanev, embedding technology into internal document management can significantly ease the usage of such information by banking professionals, which in turn improves the internal operations of the back offices.

Top banking managers debated the sector’s forecasts, the country’s business funding climate, the cybersecurity challenges, and how business and academia have been preparing the next generation of professionals that will integrate ML/intelligent algorithms in industry-specific services, e.g. credit scoring. AI is demanded by banks to help business analysts with daily reports and vast automation of repetitive tasks. The top bankers expressed their satisfaction and confidence in the development of the Bulgarian banking sector and showed their commitment to implementing the latest AI innovations. The participants also appreciated the innovative products and services that businesses are planning to launch or evolve into the sector by 2025.

All stakeholders elaborated on the challenges related to the Eurozone and corporate ESG policies, as well as the role of the banking sector in this transformation, which were also among the most important and relevant topics.