What is critical for banks to succeed when modernizing their legacy systems?

21st-century customers are demanding and expect their banks to provide innovative features and services that have long been standard for leading technology companies. But the reality is harsh - the existing core banking systems and applications have not been optimized to utilize the benefits of new technologies and easier application management. Furthermore, the operation and maintenance of these legacy systems are becoming complex and expensive, thanks to the declining number of experts with technical and institutional knowledge developed for different times.

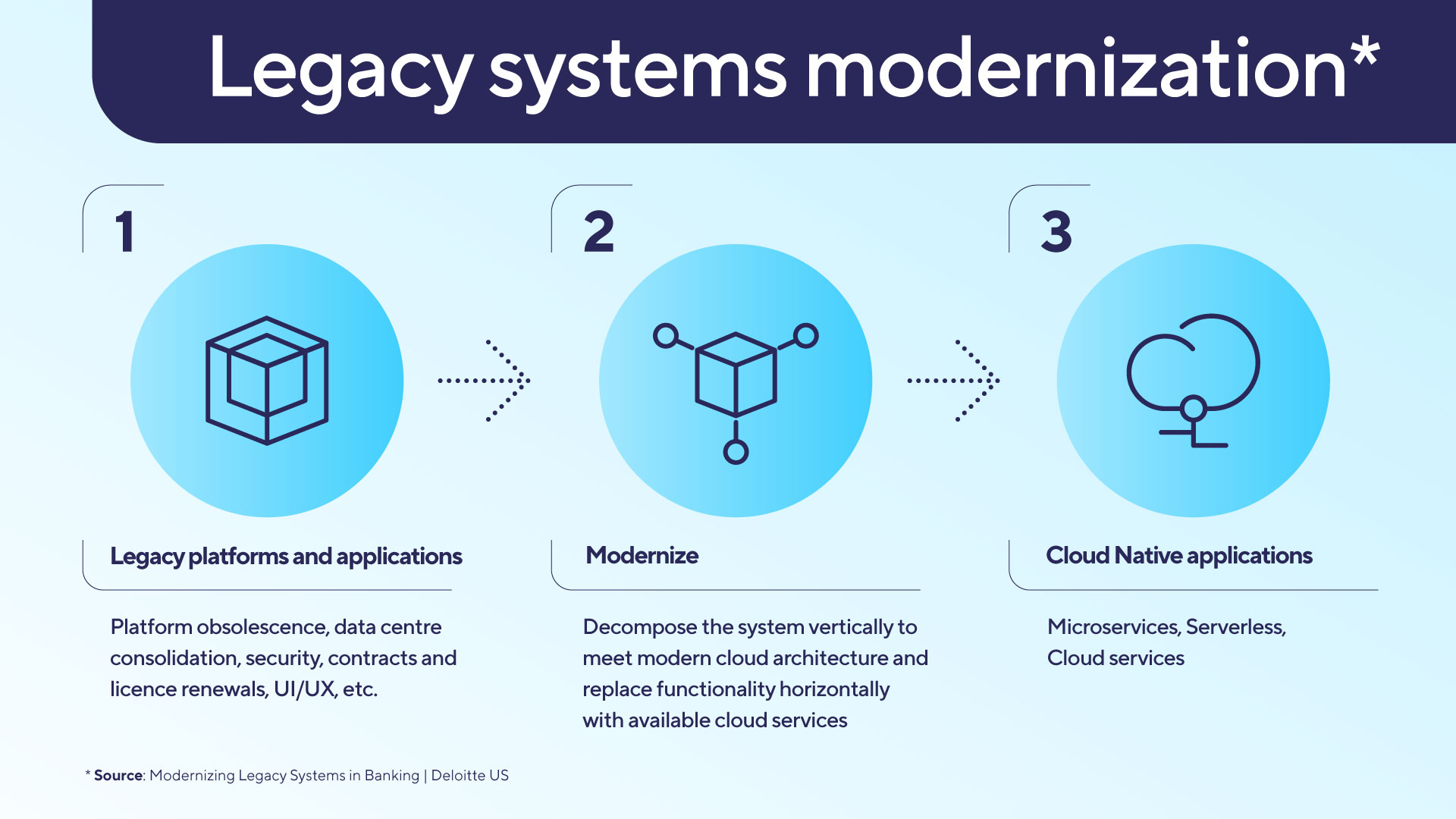

So, the disruptive forces of the technology revolution in finance have created a need for legacy systems modernization. Despite many banks are still reluctant to upgrade their core platforms and apps, the breakthroughs, and technological advances significantly improved application management. As a result, many banks are forced to embrace modernization strategies to jump into the digital era.

We understand that on the one hand, the central position those systems occupy in the overall banking architecture makes it likely that any changes to a bank’s core platforms and apps will have a widespread impact throughout its channels and operations. From another, until recently, the only available option for system modernization was a total replacement which makes the core banking platform upgrades a decision that is not welcomed by many stakeholders.

Here comes the challenge of splitting up the tangled nodes while keeping the process running?

One significant change that the conservative banking industry has embraced is the transition from a custom set of legacy mainframe applications to a configurable set of cloud applications. When it is done right, it ensures keeping the valuable intellectual property in existing business rules to help the organization solve critical issues that could affect its efforts to modernize applications and digital transformation. Moreover, the right approach to modernization can preserve the hidden knowledge for use in the future, helping organizations generate maximum business value from their existing and future applications.

The modernization process typically involves moving from mainframe-based legacy platforms to solutions built on the cloud, and other modern digital technologies.

The leading consultancy company Deloitte states that with the core system and app modernization, the new IT model for banks is shifting from in-house, on-premises deployed legacy systems to modern cloud-based systems provided by third-party vendors. The philosophy for the overall IT development in banks also is changing – banks are offered simple configuration processes rather than complex customization. As a result, the organizations are given all opportunities to mainly focus on business value creation because of the combination of state-of-the-art, cloud-native platforms that serve any core platform (system agnostic), open banking, and APIs management is opening an entirely new world before them.

The main benefits banks obtain while modernizing the legacy system

The rising demand for the banking industry’s digital transformation also became a significant part of Sirma’s core business, positioning our company among the leading providers of IT consulting and solutions implementations regarding the modernization and digitalization of legacy IT systems for banks. As an IT partner with a proven track record, we undertake a holistic approach to overall system modernization that enables banks and insurance companies to quickly offer innovative digital services and new opportunities that customers expect.

The upgrade affects both the core system and applications. It allows delivery models that are much more compatible with the latest technologies - optimized, standardized, and scalable, while at the same time entirely in line with changing market needs. We provide digital competitiveness, lower operating costs, and improved efficiency by moving from a “customization” to a “configuration” deployment model to our banking partners. The latter helps easier management of technical aspects.

One of the critical benefits that financial organizations acquire is the creation of business value, when the business cycle of the processes is improved, in the implementation of new features, increased productivity, and accelerated business growth. An excellent example of this is the creation of data insights, cognitive automation that can offer better customer satisfaction and service, and new products.

The collaboration with external IT vendors as a remedy for the talent shortage

The need for modernization has been accelerated by the growing shortage of IT talent with specific knowledge and technology expertise to keep up to date with the legacy systems. This makes it increasingly difficult and expensive for banks to operate and maintain their existing core systems. For example, COBOL programmers are rapidly aging out of the workforce, making them increasingly scarce and expensive. So too are long-tenured employees with deep knowledge of a bank’s existing systems (and the embedded business rules that contribute to the bank’s competitive advantage).

Today’s top technical talent has little desire to work with systems and platforms that are not on the top and require learning languages that are not popular or on the top of technology, and thus will keep the talent in the tight loop of a specific vertical. Modernization is changing the IT environment in banks in a way to makes it attractive to younger workers. It also shifts much of the burden from your in-house IT department to external IT vendors that have been working on such projects for years and have the know-how and an adequate resource pool. The successful collaboration with external IT providers helps banks to faster deploy innovations necessary to survive and thrive in the age of digital transformation.

Find out more in the original source.