A short story with an unexpected ending

This project started as planned information systems modernization in one of the biggest banks of the Caribbean. Everything was organized, and the blueprints of project delivery and stages of deployment were carefully crafted until the global spread of the COVID-19 led to a turnaround to this masterplan. One team that had to carry out the on-site implementation of the core banking system. A squad, challenged by the pandemic, provoked to be resourceful and start thinking out of the box how to stick to the project schedule and make the migration of critical information systems in a new way, not preferred by now.

Subsequently, it was called the new normal way.

Bank of the Bahamas (BOB) is a modern, full-service bank with 13 branches in eight islands (Nassau, Grand Bahama, Andros, Cat Island Exuma, San Salvador and Inagua) and a long history of firsts in the local Banking Industry. BOB is incorporated under the laws of the Commonwealth of The Bahamas. The Bank serves retail clients, providing personal loans and mortgages, deposits, money transfers, savings and chequing accounts, prepaid cards, and online banking. At the same time, BOB’s Corporate and Commercial Department assists the financing and cash needs of enterprises and corporate businesses throughout the country. BOB’s Private Banking and Trust division have also provided wealth services to local and international clients.

The Bank has four times received the Euromoney Award for Excellence in Banking and was named Best Bank in the Country three times by The Banker, part of the Financial Times Group. Famous as “the bank of solutions,” BOB prides itself with many “firsts” in local retail banking. We can say it not only for the services, which the bank provides to its customers but also for its innovative approach and the quick regrouping of the ongoing projects.

The project scope

BOB is an established user of Oracle technologies and a long-standing client of Sirma. The bank has planned upgrade to a new version of Oracle FLEXCUBE core banking system and migration of critical information systems (IS). The project has been planned in two phases.

Phase 1 is the upgrade of the existing core banking system Oracle’s FLEXCUBE 7.2 to the new 12.4 version across Bank of the Bahamas. Part of the upgrade is also the migration of the current systems and functionalities to the latest version, and integration with the existing satellite systems in the financial institution. The project aims to improve the retail banking processes, including functional areas of accounts and savings, customer data, loan management, front office and tellers, treasury and assets management activities. After the successful implementation of the first phase, Sirma will carry out Phase 2 that will include new banking services and modules of FLEXCUBE.

The Goal

BOB management has decided to provide total digitalization and to improve the customer services provided. For this purpose, the migration of their core banking system from the old 7.2 version to the new 12.4 version was necessary to be fast and seamless. As always, BOB turned to its technology partner Sirma Business Consulting to manage the upgrade and migration of its main information systems.

The main business and strategic objectives of the overall project:

- Significant Improvement in regulatory controls and compliance

- Timely management and regulatory reporting

- Reduction of manual data processing and increased staff efficiency

- Enhanced Customer relationship management, marketing and profitability

- Timely and accurate information, statements, etc. preparation and delivery to customers

- Ability to quickly introduce new products and services (reduced time-to-market)

- Reduced times and effort for Transaction processing and settlements

- Automation of the calculations, booking fees, charges, commissions, etc.

- Seamless and (wherever possible) on-line integration with all other satellite information systems

- Improved and efficient business and operating processes and procedures

The Challenge

The upgrade of a legacy system in a bank is more or less conventional and straightforward process. However, for the BOB project, the successful kick-off and the seamless delivery during phase 1 were interrupted by unforeseen obstacles such as the COVID-19 pandemic.

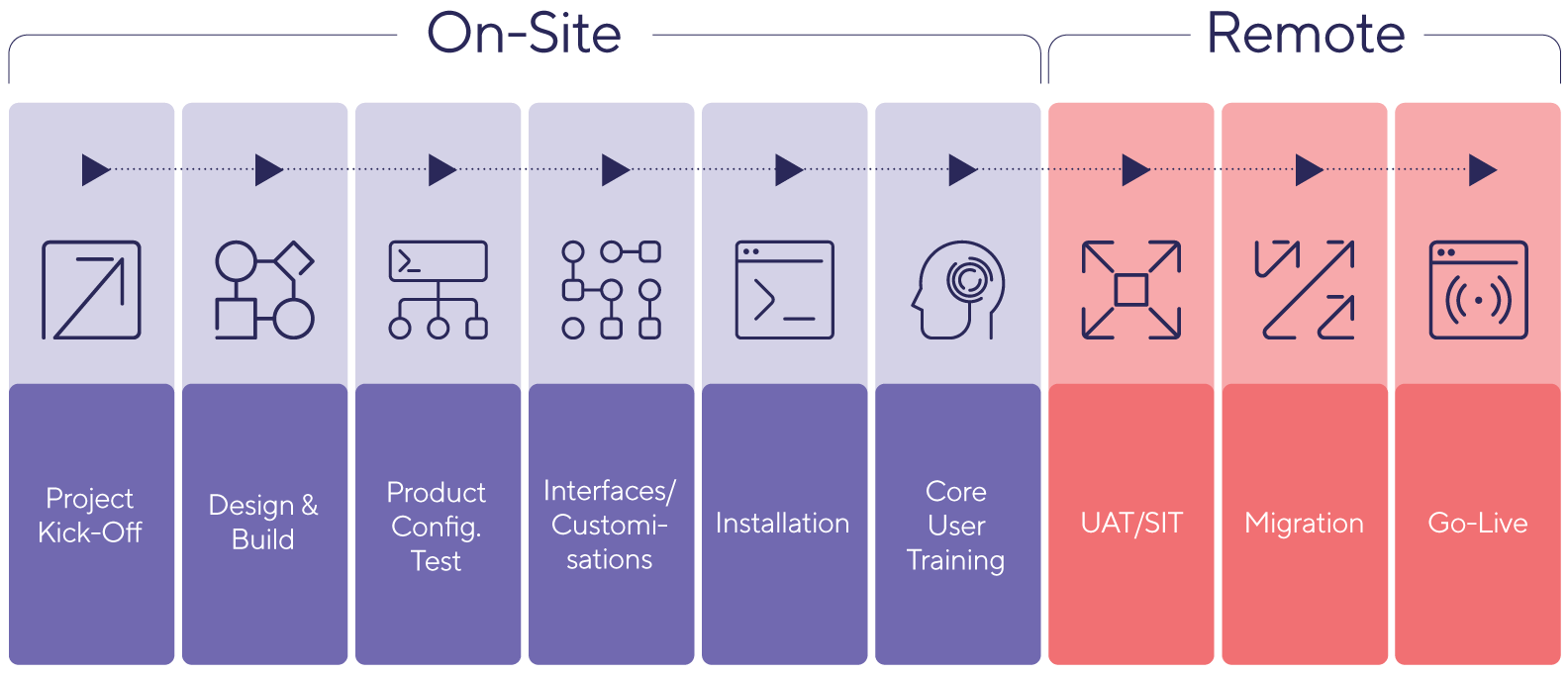

As an industry-standard, the migrations of core banking systems are executed at the location of the client bank (on-site), preferably during the less intensive months – e.g., some holiday period (to decrease client discomfort). The planned migration at BOB was precisely for the Easter holidays in the Bahamas with finalization on May 9-th, 2020. A team of 10 people from Sirma, including Sponsor, PM, BA and migration experts, travelled to the Bahamas as per the request of BOB for on-site team participation.

No one had the slightest clue that the restrictions of movement (imposed in April 2020), fighting the COVID-19 pandemic, will send both the Bank and Sirma’s team home. In this case, this meant “across the ocean.” Both teams were forced to change their way of work and to reorganize the workflow process.

The Project Lead Velko Todorov, Managing Director of Sirma Business Consulting, shared:

„It was time to think and work outside the box and to explore unconventional turnarounds. The project was challenging in terms of technology and the lockdown restrictions – we had to make total technology upgrades, overall data and IS migration to add a new feature-rich toolset. All of this has to be done remotely, not as planned straightforward on-site delivery. The timing, collaboration and sticking to the tiniest detail were crucial. And we have done it, both teams finished this complex implementation of Oracle FlexCube 12.4 on time, with the highest standards and quality of our work.“

The Results

The migration to FLEXCUBE 12.4 was successful and on time, despite the delay caused by the COVID-19 pandemic. The remote deployment successfully finished on May 09, 2020, and our client BOB has got the cutting edge banking technology. The new core banking software is provisioning to the bank new and enhanced features that help to monitor, manage, and regulate processes, compliance, and reporting, as well as ensuring enhanced digital channels support.

The new implementation is a step forward for open banking and available multiple predefined APIs with context-sensitive help. It leverages to support agile business process management, enables up-selling and cross-selling through intelligent dashboards. FLEXCUBE, with its feature-rich capabilities, helps banks to drive higher fee income with differentiated investment services, to deliver product extensibility and increased flexibility with relationship management. Last but not least, the implementation process has been carried out with ease of integration with existing systems using flexible Java Platform, Enterprise Edition technology.

Takeaways

- Both teams were succeeded, working not only remotely but also independently (from various locations across the Globe where the lockdown had placed the experts).

- The Bank of the Bahamas accomplished its full digital transformation and had yet another “first” to add to its record – a fully remote technological upgrade. Sirma had achieved its first fully remote core bank system migration.

- What both organizations fulfilled (beyond the goal at hand) is a proof of concept for other banks and technology companies. The on-site migrations of core banking systems are not necessary to be performed with the physical at-the-bank presence of all teams – from the bank and the technology vendor sides.

- It provides a use case for remote migration of critical information systems that might be executed in any location where local or regional conflicts happen, in case of new epidemic outbreaks, etc.

- This project is a showcase that the existing preference for on-site implementation lead by the delivery manager and dedicated team can be replaced with a viable solution for remote migration of critical information systems.

- Besides, the higher efficiency of remote collaboration, as well as faster task distribution via digital channels, inevitably helps to increase productivity and keep the focus during the on-going project execution. Therefore, this good precedent can illustrate a new delivery model that may replace, to a great extent the traditional on-site implementations of the enterprise-grade information systems.

- All security concerns can be well managed as setting up a secure technology environment for remote overall project delivery.

Photo credits: Cover picture is designed by master1305 / Freepik website