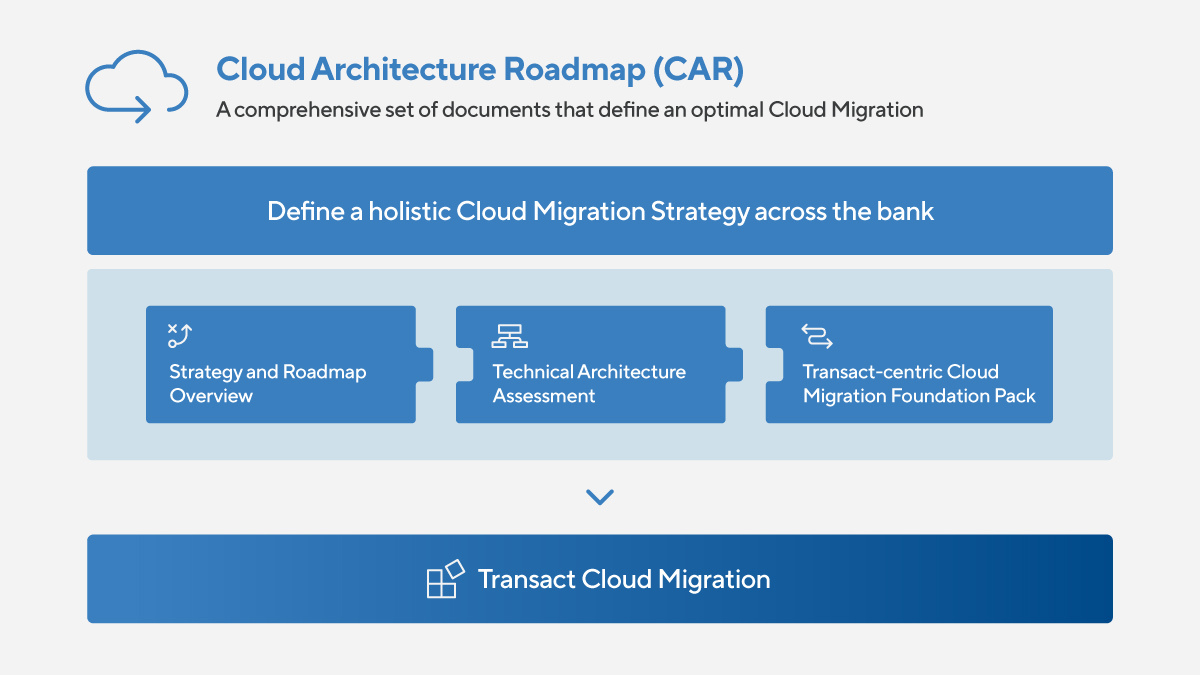

S&G Technology Services offers a unique, purpose-built, proprietary software product - Cloud Architecture Roadmap (CAR), which provides a secure, well-informed, and comprehensive foundation for migrating to the cloud.

Sofia, June 19-th 2024 – S&G Technology Services, the UK subsidiary of Sirma Group and an established provider of Temenos technology services, is proud to announce the availability of its Cloud Architecture Roadmap(CAR) solution on Temenos Exchange. This is a significant milestone as the CAR solution is supported by a robust application and is the inaugural offering of S&G Technology Services in the Exchange ecosystem, demonstrating unwavering commitment to technological advancement. By joining the Temenos Exchange, S&G’s financial innovations will be readily available to banks worldwide that run on the Temenos platform.

The new CAR solution, powered by a unique, purpose-built, proprietary software product, offers a secure, well-informed, and comprehensive foundation for cloud migration. It provides a tailored view of the overall benefits of a cloud strategy, including business agility, operational efficiency, enhanced security, reduced costs, and improved customer experience. It also offers a clear understanding of the dependencies and optimal sequencing for Temenos core banking cloud migration, leading to cost and risk reduction. Stakeholders gain greater understanding and confidence, and it serves as a basis for budget estimates.

Temenos Exchange brings innovation to market faster, and at scale. The ecosystem offers pre-integrated and approved fintech solutions that can be easily deployed on top of Temenos open platform for composable banking, enabling banks to accelerate the creation of new financial services, while reducing the costs of development.

Martin Bailey, Director of Innovation and Ecosystems at Temenos, said: “Temenos Exchange acts as an accelerator for FinTechs and software developers, helping them develop, validate, and monetize new banking solutions. The integration with Temenos and joining Temenos Exchange means S&G Technology Services can write once and be readily available to banks globally that run on our platform.”

Fabrice Gouttebroze, Managing Director of S&G Technology Services, shares “This is an important and timely milestone for S&G Technology Services. It positions the company as a reference partner for all banks in the Temenos ecosystem considering a migration to cloud or SaaS. Thank you for the deep commitment of the entire team. I would like to acknowledge the efforts of those who have helped us in this journey to become a part of Temenos Exchange, helping to build a good application to support the packaged service and confirm our capabilities in the cloud.”

He also added that “S&G Technology availability on Temenos Exchange further extends our commitment to the banking community and enables Temenos customers to reap the benefits of the Cloud Architecture Roadmap easily. We look forward to leveraging the power of the Temenos platform to help us achieve our business goals.”

About S&G Technology Services S & G Technology Services Ltd is a part of Sirma Group Holding, providing IT services and system integration in Southeast Europe. Our mission is to help banks adapt to a rapidly changing world by identifying and implementing small—to medium-high-value technology transformation initiatives. We have worked with Temenos for almost a decade, adding innovative features to their portfolio. Our successful partnership has enabled us to advise major banking groups worldwide to exceed customer expectations.

About Temenos Temenos AG (SIX: TEMN), headquartered in Geneva, is a market-leading software provider that partners with banks and other financial institutions to transform their businesses and stay ahead of a changing marketplace. Temenos core banking is the world’s most successful and widely used digital core banking solution. Using cloud-native and agnostic technology, Temenos provides the most extensive and richest set of banking functionality across retail, corporate, treasury, wealth and payments, with over 1000 banks in 150+ countries relying on it to provide market-leading and innovative products and services to their customers.