Sirma surpasses the record 2024 with a new sales jump and sustainable results

On November 27th, Sirma Group Holding presented its third-quarter 2025 financial results during a webinar hosted by the company’s top management, including Tsvetan Alexiev, CEO, and Yordan Nedev, CFO.

As one of the leading software companies in Bulgaria, Sirma reports a 33.92% increase in sales revenue, reaching BGN 84.674 million since the beginning of the year. This is shown in the company’s interim consolidated report for the third quarter of 2025, which ended on 30 September 2025.

The company is continuing to successfully implement its strategic development plan. It expects a strong final quarter of the year, surpassing last year’s record sales of BGN 100 million. A key short-term goal is to successfully list the company on the Frankfurt Stock Exchange in early 2026, which will be a significant step towards expanding its international presence and attracting more substantial institutional investors.

Key Financial Highlights

The company’s interim consolidated results show that earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to BGN 5.791 million, while net profit for the period was BGN 2.081 million.

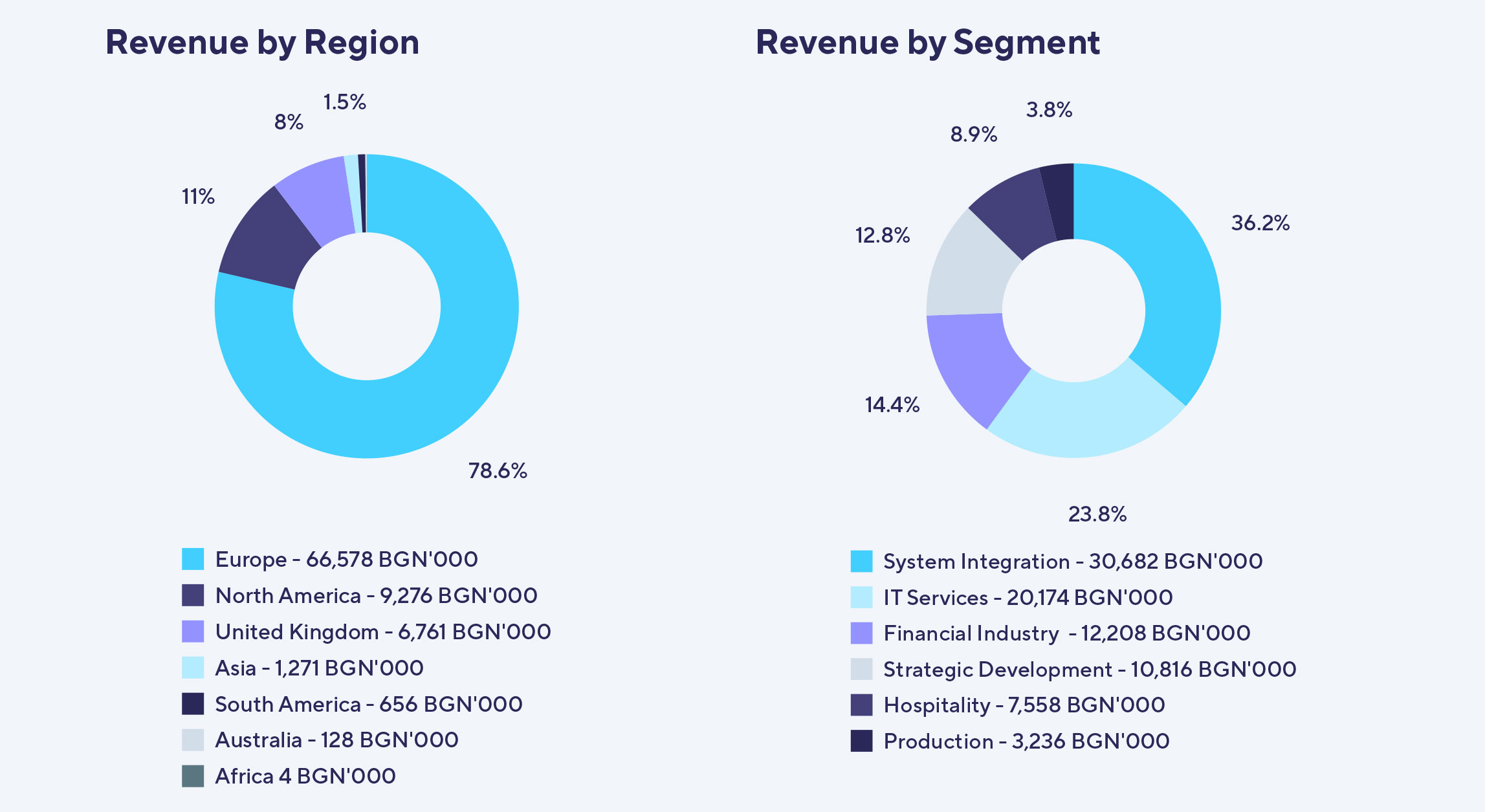

Europe remains the company’s most important market. Sales on the Old Continent account for 78.6% of its revenue. The second most important market is North America with 11%, followed by the United Kingdom with 8%.

Europe remains the company’s most important market. Sales on the Old Continent account for 78.6% of its revenue. The second most important market is North America with 11%, followed by the United Kingdom with 8%.

In terms of sales structure by segment, system integration keeps the lead with 36.2% (BGN 30.682 million), followed by IT services with 23.8% (BGN 20.174 million) and the financial industry with 14.4% (BGN 12.208 million).

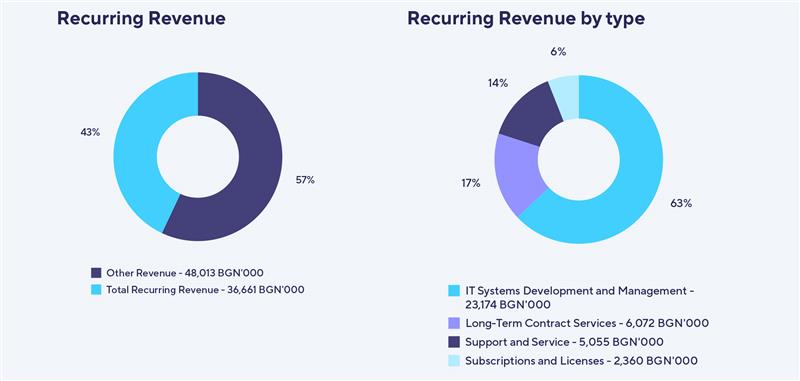

Yordan Nedev, CFO of Sirma, commented,

A consistent trend of recurring income and sustainable financial results is a key factor in achieving significant long-term growth across industries. Companies that prioritize predictable revenue streams, such as subscription models or long-term service contracts, enjoy greater financial stability and resilience against market fluctuations. This reliable cash flow supports our commitment to ongoing innovation, strategic reinvestment, and greater stakeholder confidence.

Tsvetan Alexiev, CEO of Sirma shared important updates about the latest developments in the Sirma.AI Enterprise platform.

Over the past few months, we have been working hard to evolve our own AI platform, which is currently unrivalled in Europe. Our goal is to become Europe’s leading provider of AI-based solutions. Our research indicates that large European companies prefer to collaborate with European partners, utilise European infrastructure and software, and invest in establishing a local ecosystem, in which Sirma could play a pivotal role.

He emphasised the platform’s evolving functionalities and technical capabilities. The platform features multimodel intelligence, deployment flexibility and seamless enterprise integration. Its Enterprise AI Core is the strongest competitive advantage: a centralised, intelligent architecture that simplifies complex AI systems by breaking them down into specialised, interconnected agents. Each agent operates autonomously yet collaborates seamlessly to overcome complex business challenges. The platform integrates almost all cloud-based LLMs and locally hosted models, enabling organisations to utilise artificial intelligence while retaining complete control over their data, ensuring optimal performance and security. This improves organisational processes while addressing data security, regulatory compliance and technological independence.

All solutions based on Sirma.AI Enterprise draw on the company’s extensive experience serving key industries such as finance, transportation, the public sector, healthcare, manufacturing, and hospitality, as well as its expertise in artificial intelligence spanning over 33 years.

The company’s management is optimistic about achieving its targets of €60 million in revenue for 2025 and an EBITDA increase to around 10% in the final quarter.