Sirma Group Holding JSC proudly earned its ESG rating from LSEG, marking a significant achievement in its commitment to sustainability and responsible business practices.

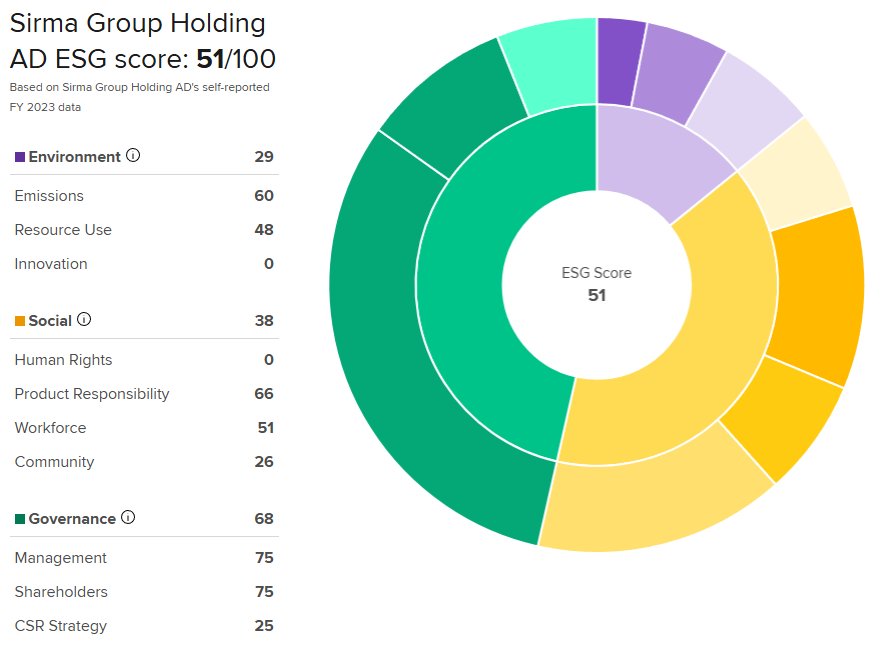

Sirma is one of the first Bulgarian companies, alongside the Bulgarian Stock Exchange-Sofia AD, to receive an ESG rating from the London Stock Exchange Group(LSEG). Our commendable score of 51 points out of 100 places Sirma among the top 303 Software & IT Services Companies globally LSEG SGH Rating.

Source: LSEG

Source: LSEG

The ESG rating methodology covers three categories: environmental, social, and governance. The 51-point rating confirms Sirma Group’s progress in each category and its readiness to meet the regulatory challenges of the Corporate Sustainability Reporting Directive (CSRD—transposed into Bulgarian legislation in 2024).

Stanislav Tanushev, Director of Investor Relations and Sustainability at Sirma Group Holding JSC, shared:

This outstanding rating of 51 points reflects the collective efforts of the entire Sirma Group team. Every colleague contributed in some way, whether by collecting ESG data, participating in various CSRD studies, or directly engaging with specific ESG topics. Isn’t that what sustainability is all about?

The rating for Sirma Group positions the company among the world’s leading public IT companies in terms of sustainability. However, this rating also requires Sirma to advance toward a more sustainable future. While this significant milestone is a point of pride for Sirma Group, it also catalyses ongoing progress. The company is committed to achieving a more sustainable future, aiming to set new industry standards and positively impact the world.

About LSEG

London Stock Exchange Group PLC. is a global provider of data and infrastructure for the financial markets. It is headquartered in the City of London, the UK. LSEG owns the London Stock Exchange, Refinitiv, LSEG Technology and more. The company offers one of the most comprehensive ESG information databases targeted explicitly at investors. It covers companies with over 90% of the world’s market capitalisation, covering over 630 ESG indicators since 2002.