The Digitalk 101 methodology ranks non-financial companies in Bulgaria’s information and communication technologies sector based on their 2023 revenue obtained from various sources, including unaudited company accounts. Here are a few highlights from the report that outlines the state of the Bulgarian ICT sector*.

In 2023, the global IT sector faced challenges and showed mixed signals. While some experts warn of a slowdown in business and hiring growth for software companies, investment interest in Bulgarian companies remains strong. Bulgaria is a technological hub with competitive rewards for positions such as senior developers, new technology specialists, and data scientists, now comparable to Western European levels.

Bulgaria’s IT landscape is experiencing a sustainable upsurge, with the top 100 companies’ average revenue growth of 10% and a healthy net margin of 15%. These firms have also expanded their workforce by an average of 3%. The ranking highlights the sector’s vitality. Total turnover climbed 10% to nearly 9.3 billion BGN, a slight slowdown from the previous year’s 13% growth. Nevertheless, IT spending in Bulgaria is projected to increase by 9% in 2024, reaching 2.4 billion euros, and maintain a compound annual growth rate of 7% until 2028, when it is expected to hit 3.2 billion euros.

Only 22 companies from the Top 100 experienced weaker revenues, with half declining by less than 10% in the reported period. Meanwhile, over 40 companies reported annual growth exceeding 20%, with 16 of them surpassing 40%. The compound annual growth rate (CAGR) for 2021-2023 for all companies in the ranking is 11%. This double-digit growth rate was achieved by 67 participants (84 in last year’s ranking), with thirteen companies growing their revenue by over 40% per year. These figures underscore Bulgaria’s IT sector, poised to continue playing a crucial role in the national economy in the coming years. The tech industry drives Bulgaria’s economy, attracting significant foreign investment and outpacing the competitive renewable energy sector.

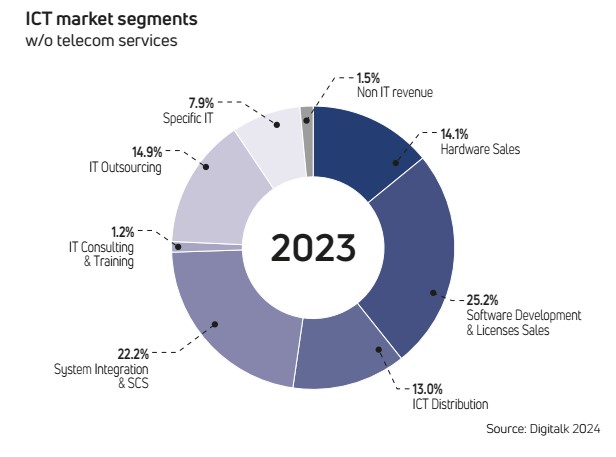

Bulgarian ICT market segments:

Despite the slowdown in the main markets (the USA and Western Europe), Bulgaria remains a well-established destination for developing and implementing intelligent systems. Major names operate the most successful R&D centres in this industry. VMware is a leader among software companies, although they did not submit data this year. Other notable companies include SAP Labs Bulgaria, Experian, Acronis, Visteon Electronics (with a new product testing centre), Paysafe, IBM, Chaos, Eviden (formerly ATOS), and Bosch Digital, alongside homegrown champions such as Sirma Group.

In this year’s ranking, Sirma moved up two places to the prestigious 14th position in the Top 50 ranking by revenue for Y2023. Sirma is ahead of many well-established international software players in the different categories of the report.

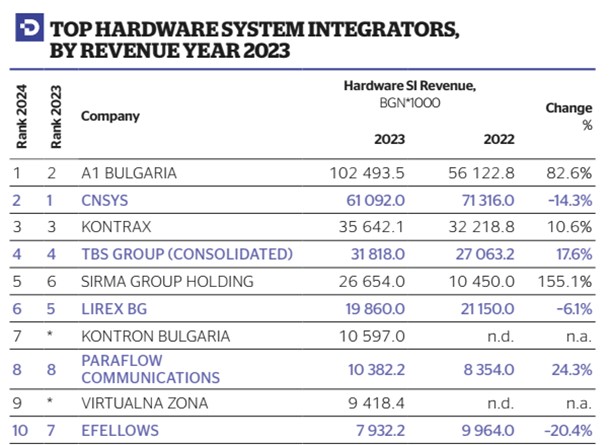

Having been the only 100% Bulgarian company, Sirma has achieved remarkable ranks, including 5th place in the Top 10 Hardware system integrators by revenue in Y2023, with 155% growth.

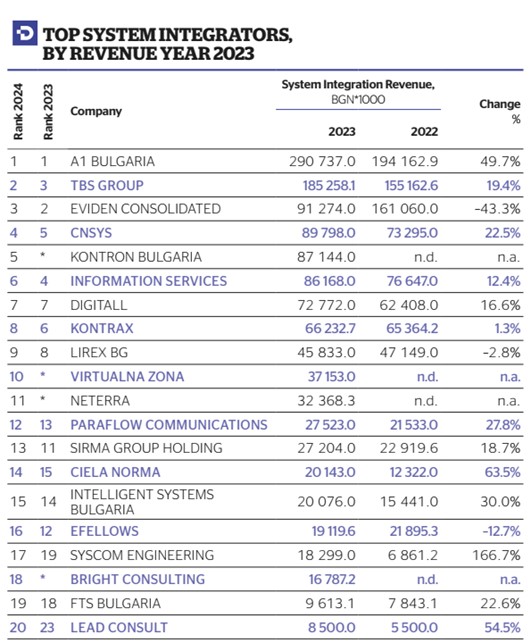

In the Top 20 System integrators by revenue Y2023, Sirma holds the 13th position and accounts for 18,7% growth.

Bulgarian software developers are global leaders, offering AI-based solutions with many cloud implementations for clients worldwide. Bulgaria’s tech companies serve a diverse client base, including major finance, insurance, retail, pharmaceuticals, production, and energy players, primarily in Western Europe and the United States. The sector also supports small and medium-sized businesses through European funding programs. Cybersecurity, public cloud solutions, and IoT are rapidly expanding segments. Public cloud spending is projected to be dominated by Software as a Service (SaaS), with Platform as a Service (PaaS) showing the most rapid growth in the next four years.

In 2023, Sirma undertook corporate restructuring to consolidate expertise, assets, and teams and improve strategic and operational management. The strategic goal of this corporate consolidation is to improve competitiveness and market positioning, leading to new business opportunities, a wider range of customer services, and streamlined administrative processes. The restructuring will be completed in the second half of 2024, merging all IT service subsidiaries into SGH to form a single operational company.

Sirma also updated its corporate strategy for international expansion and continued progressing with extending its global footprint. The company is confident in gaining new business in North America and increasing revenue by 10-12% through expanding its customer and employee base. At the end of June, Sirma signed an agreement to acquire a majority stake in the Romanian software company Roweb Development SRL. This acquisition will bolster Sirma’s presence in the Balkan IT market and expand our IT services portfolio. The next step is a new acquisition from the Nordic region.

Source and copyrights: Digitalk 101 edition 2024. The full version of the report is available by purchase here, and the summary is accessible for registered users.